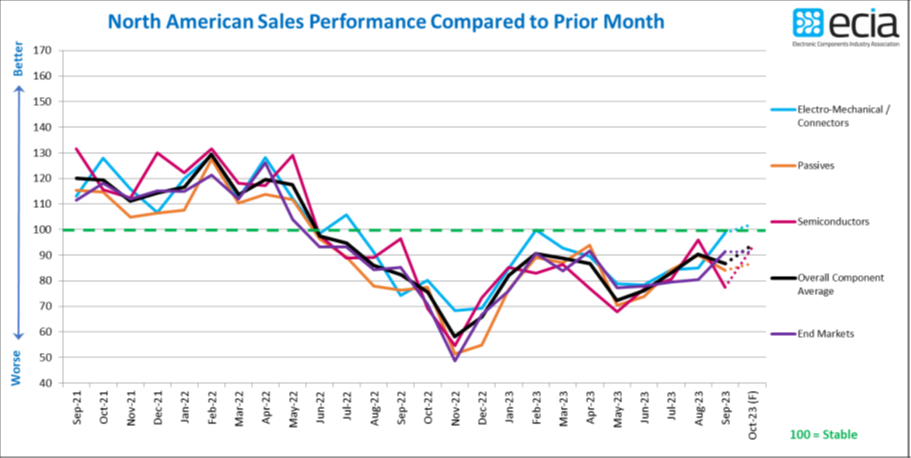

ECIA reported that the latest results of the September sales confidence survey show that the overall electronic components market index is difficult to continue to improve. The latest headline index for September fell 3.6 points to 86.7.

Last month’s survey results showed that the sales confidence of electronic components continued to improve in August, and the business index was 90.3, continuing the performance improvement trend that began in June this year; Looking ahead to September at that time, the index was expected to maintain its upward trend and reach 94.9.

However, the actual results for September were disappointing, with the index below expectations. But ECIA stressed that the industry continues to maintain a positive outlook. Looking ahead to October, survey participants expect industry sentiment to improve to 94.0, the highest level since July 2022 and just six points below the 100 mark that indicates sales growth.

- The most encouraging results in September were electromechanical/connector components. The category improved 13.8 points to 98.7 in September, and the outlook expects the category to move into positive growth territory in October.

- Unfortunately, the semiconductor sector index has lost all its gains since August, falling to 77.4; Hopes for the future market continue to drive the outlook for the semiconductor sector in October, with expectations rising 15.7 points.

- Although the change is more modest, the gains of passive devices in August also evaporated in September, and a slight improvement is expected in October.

While September’s findings suggest that the electronic components industry has suffered a setback in its recovery, the industry is still likely to reach the break-even point by the end of the year, with the potential to return to broad-based growth in early 2024.

In the September survey, the sales confidence gap between upstream manufacturer representatives and downstream sales representatives and distributors persisted. This significant disconnect began in April, widened in June and July, and narrowed in August and September. However, there are still clear differences in views. The index for distributors in September was almost 100 or above. The upstream manufacturers index is also high, at around 100. In contrast, the downstream representative index is between 44 and 87. Given that distributors are reporting such positive results, it is difficult to attribute this discrepancy to the need to address inventory balance. Still, upstream manufacturers and distributors see a world that is fairly aligned with end-market demand, while downstream representatives seem to be struggling in the current market.

The overall end-market index jumped to 91.4 in September and maintained that level in the October outlook.

Scores and improvements were uneven across markets. The avionics/Military/aerospace index was maintained and improved to more than 100 points. The index for medical devices and industrial electronics reached around 90 points in September. The most positive outcome of the end-market survey is that all indices are expected to improve significantly, with double-digit growth expected in October.

The picture of product delivery cycle trends has developed into a very healthy indicator. Stable lead times dominated, with stable average lead times jumping from 61 in August to 69 in September. In September, there were zero reported increases in delivery times for the passive component category. In addition, there was no increase in lead times for MPU, MCU and discrete products. The delivery time results in the ECST survey again provide some positive signals.